Young and the poorly rested

CanadaEntertainmentEnvironmentHealthHealthLifestyleLifestyleNewsOpinionUncategorized Feb 14, 2019 Tierney Angus

By: Alex Arsenych and Tierney Angus

The following article may be triggering for millennials who are always tired, bogged down by responsibilities that are a struggle to juggle and who feel guilty for complaining about the inability to complete the simple and menial tasks of “adulting.”

The following article may be triggering for millennials who are always tired, bogged down by responsibilities that are a struggle to juggle and who feel guilty for complaining about the inability to complete the simple and menial tasks of “adulting.”

If you are a millennial, beginning to feel stressed about what this article is even about before you read it, it’s really fine. We’re here to inform you about “millennial burnout.” Just know that you are not alone and that a lot of people your age are experiencing this exact same thing.

Misery loves company, right?

Earlier this year, BuzzFeed News published an article called “How Millennials Became The Burnout Generation.” In about 7,655 words, Anne Helen Peterson breaks down the minutiae of a day-in-the-life of a millennial and the obstacles that we have to conquer thanks to previous generations and our current socio-economic climate.

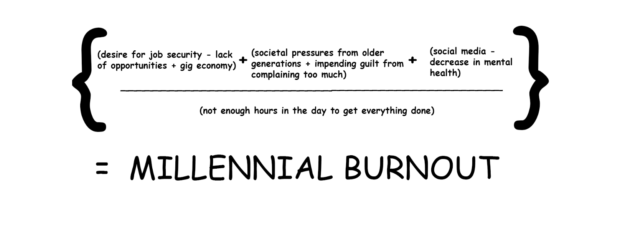

For a TL;DR breakdown of what millennial burnout is, here’s a simple equation in friendly Comic Sans:

Millennials are branded with the destructive stereotype of being whiny, self-involved, entitled, and lazy twenty to thirty-somethings who still live with parents.

Putting off an objectively simple task, like sending an overdue email or folding a Mt. Everest-sized mountain of laundry is called “errand paralysis.”

This paralysis could also be due to the fact that Canadian millennials are the most anxious and depressed generation compared to all others.

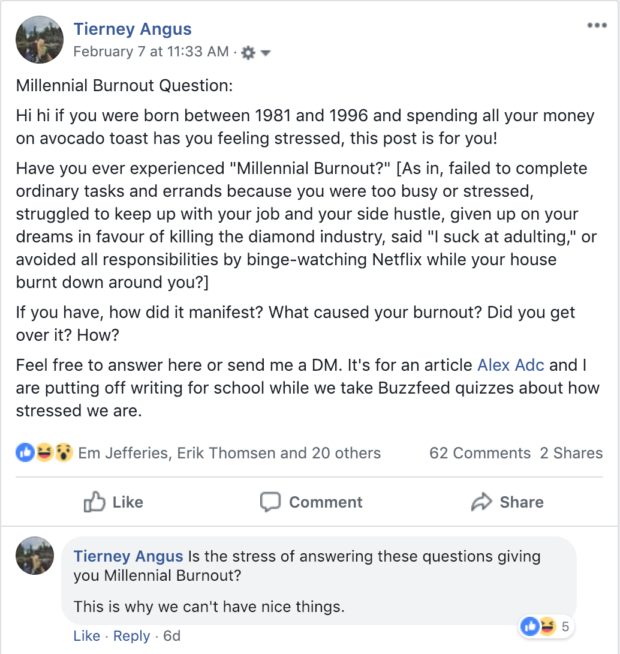

Through social media (of course), we asked millennials if they’re feeling the burn and how they deal with it.

Burn, baby, burn

“I want to answer but I’m stressed!” wrote Kaye Hamilton, 30, traffic coordinator. “Are there actually therapy dogs on campus now? I tried to get my work to enact a dog-friendly policy (citing mental health benefits as one of the reasons for said policy) but I received a strong NO. I could have used some puppy therapy [in college] while my soul and dreams were being crushed and left to die.”

Emma Monet, 23, works two jobs as a stage manager and AV attendant.

“The true burnout usually happens when I finally get a day off from my jobs,” Monet wrote. “I tell myself that I have to use that time to handle the aspects of my life that I put off for work, but instead I am completely immobilized. I watch the laundry pile grow, my bank account shrink, and my life spiral further out of control until the moment that I have to pick myself up and go back to work again – still tired, and angry at myself for being a lazy millennial cliché.”

Brad Jennings, 28, has a good-paying government job with the Ministry of Natural Resources and Forestry. Despite this, he still struggles to pay off his student loans and have enough money left over for everything else.

“Every time payday comes I watch it disappear into the omnipresent student loan account,” Jennings wrote. “[I’m] left wondering if I could own 1/16th of a home by the time I’m 40, then decide if it’s best to spend the remainder on gas, food or health. Repeat bi-weekly.”

Caroline Toal, 28, is an actor.

“At one point I had four part-time jobs trying to make ends meet and support myself in between acting gigs,” Toal wrote. “It was exhausting trying to pay all my bills and it was exhausting to always feel like a failure and a loser for not being able to live up to society’s standards.”

Getting that bread? 💸💸💸

The financial pinch is a common thread.

“Wages are completely out of whack with inflation,” wrote real estate agent Cory Seaman, 37. “Baby boomers won’t leave their jobs and retire. They also expect you to have a masters degree to do the exact same job they walked into out of high school but they only want to pay $19 an hour. Boomers can keep shitting on millennials all they want, but all I see from millennials is hard workers trying to make ends meet when we aren’t being handed everything like our parents’ generation was.”

Even the millennials who have managed to get married, have kids and buy a house are barely making payments with two incomes.

“My car was due for an oil change a year ago… I’m not making that up,” wrote Meghan Clark, 35, marketing and communications specialist for the University of Guelph.

Clark has two boys. Her husband, Fraser Clark, owns an outdoor sporting goods store.

“Cash flow management can be crippling. Car needs full-synthetic which will be $100 and that $100 needs to go to something else this week so it gets put off,” Clark wrote.

View this post on Instagram

Lacey Klowak, 31, worries about the cost of her mortgage despite help from her parents for the down payment.

“Our goal is to rent it to pay off our loan from our parents. Otherwise we don’t make enough money collectively to pay it off,” Klowak wrote. “I was in social work and now do home daycare because if I had my two kids in daycare, I would be paying a second mortgage and we’d be even more behind in paying this loan off.”

Everyday I’m hustlin’ strugglin’

Many millennials work multiple jobs or have side hustles so they can pay their bills. While the side hustles are generally things that involve a personal interest or passion, sometimes the fun ends up being nothing more than extra work.

Brad Jennings’ passion is adventure racing.

View this post on Instagram

“Thank goodness for side hustles and sponsors/team coverage stuff. Helps with achieving the majority of the fun things (de-stressors), but there’s always work involved,” Jennings wrote. “Like when I do a four-hour race and then have to edit the video for 10 hours but I’m feeling drained and uninspired from working the real job all day. I couldn’t afford the race if I didn’t do the media thing, but they’re so good for my mental well being. Or you get paid for something and you’re like, “Sweet, I got paid for this?!” but then you work on the required product for hours and realize your pay is, like, less than two dollars an hour.”

For some, the side hustle game isn’t worth the effort.

“It definitely ruins the fun for me,” Meghan Clark wrote. “It was awful. I’m much happier not trying to make my passion into my career which is probably the exact opposite of what we hear so often.”

Heather Mills, 31, is an elementary school dance teacher. She says social media forces millennials to always be busy.

“I feel like there is added pressure from Instagram and social media to always be working and have a side hustle,” Mills wrote. “I feel like the majority of people who use social media consistently do so because they have a business they are promoting. This makes it feel like everyone has a business or side hustle, which I don’t think is true, and puts pressure on the rest of us to always be working.”

View this post on Instagram

Mr. Brightside?

It’s not all doom and gloom, though. Millennials are resourceful and are inventing coping mechanisms to deal with their unique situations. Hint: it’s not by buying overpriced avocado toast.

Anna Martin, 30, runs her own non-profit and manages to have a work/life balance most people – not just millennials – would be envious of.

“I ran away to Australia where there is warmth and beaches, easy money for all things side hustle, and a minimum wage of $23 an hour on casual rate,” Martin wrote.

“It’s a constant struggle,” wrote Toal. “I found that working out and really delving into spirituality helped me try to focus on the positive.”

Klowak agrees.

“I think also it’s important for our generation to know how to manage our stress and anxiety. Whether it’s meditation or counselling etc., I’m happy to see that more people are so forthcoming with their mental health issues nowadays for that reason.”

Others hacked the system. The avocado-toast system, that is.

“[Avocados are] three for $2 on sale and a loaf of bread is $3. So, like, $1.50 for a meal. Not sure if that’s bankrupting me or the cost of the hydro to run the toaster,” Jennings joked.

For some, making a plan and sticking to it helps them get through the rough spots.

“Actually coming up with a real five-year plan and a path to achieve it has helped with my anxiety,” Clark wrote. “Also, edibles.”

*Interviews have been edited for length and clarity.