Overheated rentals market affects Toronto youth

CanadaNewsTorontoToronto Oct 20, 2021 Krystyna Shchedrina

Despite the real estate market experienced a slowdown and price slump at the beginning of the pandemic, it is now overheating. The prices are expected to keep skyrocketing, a Toronto realtor says.

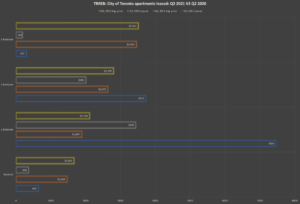

According to the recent report published by Toronto Regional Real Estate Board (TRREB), in the second quarter of this year, the overall condominium apartment rental transactions are 13 per cent higher than in the second quarter of 2020. The growth in the rental transactions caused a spike in the total number of listed units. TRREB’s quarterly reports say in the second quarter of 2021, just under 25,000 units were listed in Toronto and GTA, with over 20,000 in the city of Toronto, with over a half of them leased. However, exactly a year ago, only a third of nearly 22,000 units listed were leased. Now, the prices are rapidly crawling up, complicating living in Toronto for younger generations and international students.

According to the recent report published by Toronto Regional Real Estate Board (TRREB), in the second quarter of this year, the overall condominium apartment rental transactions are 13 per cent higher than in the second quarter of 2020. The growth in the rental transactions caused a spike in the total number of listed units. TRREB’s quarterly reports say in the second quarter of 2021, just under 25 thousand units were listed in Toronto and GTA, with over 20 thousand in the city of Toronto, with over a half of them leased.

The report indicates a 3.7 per cent growth in average one-bedroom condominium apartment rent compared to Q1 2021, while the two-bedroom rent is up by just under six per cent.

Julian Kashani, a real estate sales representative at property.ca, says three factors explain such growth. Firstly, says Kashani, an increased demand links directly to international students coming back to Toronto. Most international students have roommates to save money, so it is cheaper and easier to rent. The demand had gone up drastically since the Covid-19 vaccine rollout since no one was willing to put their health at risk living with another person that is not in their bubble to save money. Another significant factor here is the hospitality industry since some aspiring youth do not make a lot of money and have to sub-lease the second room in the apartment. And finally, with lots of jobs switching to remote work, many professionals prefer to rent a two-bedroom apartment to use the second room as a home office.

Kashani says that with tourists coming back to Toronto, more units will be offered for a short-term lease, as Airbnbs, for example. He says it definitely might take some one and two-bedroom units off the market, but, he says, the demand for long-term rentals will still increase.

Even though prices in the rental market are rapidly going up, Kashani says the sales market has started overheating much earlier because there was always confidence in the market.

“In January, people saw the end of the tunnel, they saw the vaccine coming, and there was hope. So, everybody jumped to buy condos. Within a couple of months, by March or April, we were back at the pre-Covid prices. People were overpaying because there was so much demand, and it hasn’t stopped since. The prices are still going up, and the market is hot in terms of buying. In terms of renting, it started slowly getting better. By August, the rental market was on fire since the international students were back, and downtown was alive again.”

According to the 2020 report of Global Affairs Canada, international students have contributed almost $18.5 billion to the Canadian economy and over $22 billion in 2018, paying for accommodation, tuition, transportation and discretionary spending. The report also shows the biggest share of long-term international students resides in Ontario (47 per cent in 2017, rose to 48 per cent in 2018).

This could mean international students returning to Canada as the vaccine rollout continues could mean a further boost in the country’s economy and budget. However, as many countries were hit by the Covid-19 pandemic harder than Canada, many international students find themselves in difficult positions since some simply cannot afford to live in the city anymore.

“Toronto is a very prosperous city, which will only expand and grow in the future – the big US companies are coming here to invest, for example, Amazon, Tesla. They’re all investing here. I see Toronto growing, and I see Toronto becoming a bigger city. In many years, this will become a place like New York, with generations of renters because the price will get so high that many people will not be able to buy, and it’s going to become normal for them to rent. It’s going to be harder and harder for the new generation to become a homeowner. I think that’s where we are headed,” Kashani says.

Kashani says some domestic and international students are moving outside of Toronto, to the GTA and smaller cities to go to school. Kashani says this movement will not have an effect on the market in the long run.

“Yes, the cost of living becomes more expensive. Look at cities like London, Paris, New York. But I believe we are going to get wealthier international students. For sure, it is going to stop some people, but others will definitely be coming, ” says Kashani.